Latest News & Updates

Cash Flow Management for Small Businesses: 5 Top Tips (Video)

What exactly is cash flow management for small businesses, and why is it so important for businesses to understand this financial aspect? Cash flow management is the strategic administration of a company's cash inflows and outflows, making sure that there is always...

5 Essential Tips for Cash Flow Management

In last week's episode of I Hate Numbers, we emphasized the critical nature of cash flow forecasting for businesses. Now, in Episode 217, we're shifting focus to share five essential cash flow management tips every small business owner needs to know....

Why Cash Flow Forecasting is Critical to Success

Have you ever thought about what separates a successful business from the rest? It's more than simply having a fantastic product or service; it's also about mastering the art of cash flow forecasting. The power of cash flow forecasting It is more than just calculating...

More business success with Cash Flow Forecasting

In the latest episode of the I Hate Numbers podcast, we shed light on the indispensable role of Cash Flow Forecasting in ensuring the success of your business endeavours. Understanding the Ups and Downs Cash Flow Forecasting serves as a beacon, guiding...

Why Cloud Accounting Is Bad for Business (7 Reasons)

Are you a business owner managing the complex world of financial management? In today's digital age, cloud accounting has emerged as an appealing solution that promises efficiency and accessibility. But is it really the right fit for every business? In my latest...

The Benefits of Cloud Accounting for Businesses

In our pursuit of simplifying clients' lives and alleviating stress, the "I Hate Numbers" podcast delves into the benefits of cloud accounting this week. Time Saving Benefits Transitioning to cloud accounting not only saves time but also...

Why Your Business Needs Cloud Accounting

The importance of cloud accounting for businesses cannot be overstated. This innovative approach to financial management offers a range of benefits that can significantly impact a company's operations. Let me rephrase this, and start over... Firstly, I'd like to ask...

5 reasons you should Ignore Cloud Accounting

In today's episode of the I Hate Numbers podcast, we're delving into five compelling reasons why we, as business owners, should consider ignoring cloud accounting. Stick with us until the end for valuable insights. First and foremost, let's...

How to Build a Great Business: The 7 Elements of Success

Are you wondering how to build a great business? What’s the secret? Well, it’s no secret at all. Firstly, build it by creating something valuable that people want and need. It's about solving problems, making life easier, or offering something unique and desirable....

Seven Key Ingredients for Overnight Success

In this week's episode of the I Hate Numbers podcast, we're exploring the fascinating journey to success. What do Abraham Lincoln, Dr. Seuss, Michael Jordan, and other renowned figures have in common? Contrary to popular belief, their success wasn't an...

Planning for Business Growth: How Planning Helps Your Business?

Planning is like making a map for your business journey. It's super important because it shows you where to go and how to get there. Let's see why planning for business growth can make a big difference for your business. Can you beat the odds and succeed without a...

The Benefits of Planning For Businesses

In this episode, additionally, we delve into the importance of planning in business endeavours. As entrepreneurs, we're often enticed by spontaneity and agility, yet the question remains: is it truly viable to forgo meticulous planning? Let's explore the...

Tax Adjustments: Take Responsibility for Your Tax (Video)

Did you know that if you take responsibility for your tax, you have good chances of reducing your tax bills by making tax adjustments? This involves understanding and fulfilling your tax obligations. Understanding taxes in the UK In my video about the UK Tax System,...

Have you paid too much tax?

Have you paid too much tax? In this week's episode of the I Hate Numbers podcast, we explore the fundamental criteria shaping the UK tax system and why understanding it matters. We delve into the implications for individual taxpayers and businesses,...

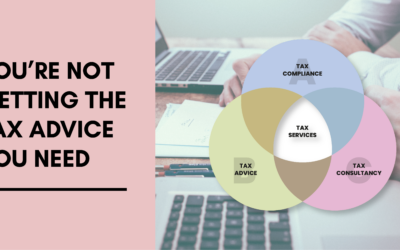

You’re not getting the tax advice you need

There’s an unspoken truth when it comes to tax advice: for business owners, there’s a complete lack of transparency from advisors over what tax advice actually is. This means as a business owner: …..you don’t know what to expect from your accountant …..you don’t...

32 Ways to Get the Maximum Value out of your Business

A question I get asked all the time is: ‘What can I take out of my business?’ and ‘how do I save more tax?’ Well, the quick answer is, ‘there’s up to 32 ways to get value out of your business, tax efficiently.' But the truth is, not all these 32 Ways to Get the...

Are You Eligible For R&D Tax Relief?

We’d like to draw your attention to a Tax Relief, R&D Tax Relief. R&D Tax Relief was introduced by the government to support and incentivise innovation amongst small and medium sized UK businesses. Qualifying businesses can make an R&D Tax Relief claim up...

Describing Yourself as a Business

In the world of business, the way you describe yourself holds significance - no matter if you are a startup, freelancer, or a charity. You can shape other people’s perceptions and make meaningful connections by saying the right things when describing yourself as a...

How do you describe your business

How do you describe your business in the business world? In this week's episode of the "I Hate Numbers" podcast, we tackle a topic often overlooked but with significant implications. You might wonder, "What's in the name?" Well, it turns out, quite a lot....

Tax Effective Giving Benefits Everyone (Video)

Are you looking to make a difference while maximising your financial benefits? Tax effective giving is more than just a charitable act; it's a smart way to give back that can offer significant financial advantages. With tax effective giving, you can experience the joy...

Tax effective charitable giving

https://player.captivate.fm/episode/fc39981b-1547-4379-a9eb-daa4d6758252 In today's episode, we explore tax-effective giving strategies for supporting charities in the United Kingdom. We'll delve into various methods individuals can employ to make donations while...

Tax Relief for Donations to Charity: Understanding Tax Benefits

Are you aware that your charitable giving could have a significant impact on your tax situation? Charitable giving and taxes may seem like distant concepts, but they're closely related in the world of finance. Introducing tax relief for donations to charity. Tax...

Understanding the Impact of Gift Aid and Charitable Giving

In this episode, we delve into the intricacies of the Gift Aid scheme and its profound impact on charitable giving. Since its inception in 1990 in the UK, Gift Aid has revolutionized the way individuals contribute to charities and Community Amateur Sports Clubs...

How to Approach Tax Planning for 2024: Tax Expert Tips (Video)

Planning and budgeting for your tax return is something we highly recommend to all our clients. Firstly, it brings a feeling of safety. Then it also lessens your anxiety as a business owner and allows for clarity in decision-making. But if you're not sure how to...