Latest News & Updates

How to claim Carers Allowance

Are you a carer and want to know How to claim Carers Allowance? What is Carer’s allowance? This is money given to people who look after someone with substantial caring needs. It’s not means-tested, so it doesn’t matter how much you earn or own. Furthermore, if...

Claiming Carers Allowance

Claiming Carers Allowance is this week’s vlog. Furthermore, you may ask why. It’s a sad fact that nearly £1.3 billion worth of unclaimed carer's allowance in the United Kingdom. That’s almost 400,000 people who care for friends or relatives who are are missing out...

Understanding the UK Construction Industry Scheme

Explaining the CIS scheme is this week's I Hate Numbers podcast. Read more to see what is covered Firstly, what the CIS scheme covers Secondly, what a contractor or subcontractor is Thirdly, requirements are in terms of reporting, in terms of registration,...

The Construction Industry Scheme (CIS))

The Construction Industry Scheme (CIS) was introduced in 1971 to combat serious tax evasion in the industry. The CIS scheme has rules as to how contractors should make payments to sub-contractors. What are contractors? Contractors typically provide agreed services...

The BREATHING mnemonic for success in business

Success is all about BREATHING. I don't mean what your lungs do but the nine magic ingredients represented by the mnemonic BREATHING. Are you a business owner? Do you want to be successful in your business? If so, then this episode is for you. In this episode...

BREATHING leads to business success

BREATHING leads to business success. Do you want to know what it takes to be successful in your business? If so, then I've got something for you. In this video, I'm going to outline the ingredients that will help you achieve success in your own business. It's a blend...

Difference between tax evasion and avoidance

Understanding tax evasion and avoidance is an essential piece of knowledge! Even if just to avoid prison food. Do you Understand tax evasion and tax avoidance? Moreover, do you know the difference between tax evasion and avoidance? Firstly In this podcast, I...

Tax avoidance and tax evasion

Understanding the differences between tax avoidance and tax evasion, is an essential piece of knowledge for all taxpayers, whether you are an individual or whether you are a business. Tax avoidance and evasion is typical and headline news. Jimmy Carr, Gary Barlow, Ken...

Use a Limited Liability Partnership

Using a Limited Liability Partnership is this week's podcast theme. Are you looking to set up a Limited Liability Partnership? A limited liability partnership (LLP) has many of the features of a normal partnership and a company. In this podcast, I will explain...

Limited Liability Partnership

A Limited Liability Partnership is like a duck billed platypus. A duck billed platypus is a bit of every animal. Likewise, a Limited Liability Partnership (LLP) shares many of the features of a normal partnership, blended with that of a company. Moreover, it also...

Makinging business partnerships work

Making your business partnership work can be one of the greatest pleasures of having your own business. With that in mind, if you’re planning to start a business venture with a friend, family member or associate as your business partner read on. Don’t assume...

Tips for effective business partnerships

Tips for effective business partnerships is this weeks vlog. Making your business partnership work can be daunting if you have never had a partnership. There are many things to consider, especially if you intend to start a partnership with a friend or a family...

Creating a successful employee handbook

A successful employee handbook is what helps reduce your business heartache. Problems within a business can occur because there is a lack of clarity on some subjects. Mainly, the issues which arise are around the expectations of the business. The employees and...

All about employee handbooks

If you ever find yourself asking: “Why do I even need an employee handbook to begin with?” – don’t! Employee handbooks are more than listing policies and complying with procedures. The best-crafted employee handbooks serve as a reminder about the company’s vision,...

Changing from sole trader to company

How to change from a sole trader into a company is this week’s podcast. What are the two most popular business structures in the UK and beyond? They are the sole trader or limited company. Likewise, a limited company in the United States and elsewhere is...

Sole trader to a limited company

How to change from a sole trader into a limited company is this week’s topic. Are you thinking about changing from a sole trader to a limited company? There are many reasons why this might be the case. Tax issues and wanting more protection for your business are the...

Furlough Finishes – Next Steps

Are you a business owner then this podcast Furlough Finishes - Next Steps is for you! You'll learn What housekeeping exercises are needed How to deal with over claims The entries to be made in your tax return, self-employed or CT form. It's all jargon-free so...

Furlough Grant – Next Steps

Furlough Grant – Next Steps is a must know topic. Furthermore, even though the scheme has ended there is housekeeping to be done. Records, compliance and reporting to HMRC is still on the radar. If you are an employer, whether you're a self-employed employer or a...

Growing your business – avoid overtrading

Business Growth and Overtrading is one of the biggest problems facing businesses today, Furthermore it impacts start ups to established businesses. It's easy enough to avoid if you know what signs look like but many companies simply don't have the time or expertise...

How to spot and fix overtrading

Have you ever wondered how to spot and fix overtrading? If so, then this video is for you. Over the next few minutes, I'm going to show you how to spot and fix overtrading in your business. So, let's get started! Are you looking to grow your business? If so, then it's...

Holiday pay entitlement

Are you looking at a way of Calculating holiday pay entitlement ? Calculating holiday entitlement can be complicated, but it doesn’t have to be. In this week’s I Hate Numbers podcast I am going to look at how to calculate leave entitlements, the leave period and how...

Understanding holiday pay

Understanding holiday pay, and how to calculate it is vital for any business that has workers. Are you a business, private or not for profit? If so, then this video is for you. Firstly, I'm going to explain how holiday pay works in the UK Secondly, how you calculate...

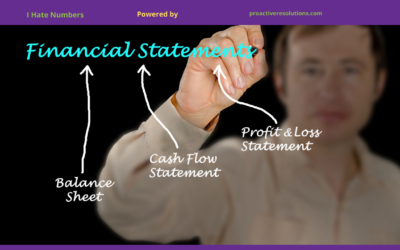

Your financial statements

Understanding your financial statements is connecting to your business story. Your financial statements are your business stories, the words those stories are made up of numbers. Figuring out what they mean can be a daunting task for any business owner. Understanding...

Financial Statements explained

Financial Statements explained is this weeks video, understanding them is a big deal. Above all the financial statements form the bedrock of any company. Therefore understanding them and how they work gives you insight and clarity. In this video I'll talk you through...