HMRC is changing how landlords report income and expenses. Making Tax Digital for Income Tax Self Assessment (MTD for ITSA) is coming. This new system affects many landlords from April 2026. Are you ready for these changes? MTD for Landlords: What You Need to Know MTD...

tax articles

Interest Tax Relief On Mixed Use Properties

Understanding how Interest Tax Relief on Mixed Use Properties works is crucial for landlords. The tax treatment varies depending on whether the property is residential or commercial. Applying the correct rules ensures landlords maximise their tax relief while staying...

How PAYE Started and Why It Matters

PAYE (Pay As You Earn) is a cornerstone of the UK tax system. Whether you’re an employer or an employee, understanding how it works is crucial. Since its introduction in 1944, it has simplified tax collection by taking income tax, National Insurance, and other...

Temporary Workplaces and Tax

Temporary Workplaces and Tax, well where do you work matters for your taxes. Before COVID , most employees worked at a permanent workplace. This was usually the same office every day. Now, many people work from home and the office. Flexible working is common, and it...

Reporting Residential Property Gains

Selling a second home or investment property means Reporting Residential Property Gains. Owners must report residential property gains and pay capital gains tax (CGT) within strict deadlines. Failing to comply can result in penalties and interest charges. Why Sell a...

How VAT in the UK Works and How to Stay Compliant

VAT in the UK is a crucial tax that affects businesses and consumers alike. It applies to most goods and services, making it essential for companies to understand their obligations. Furthermore, businesses must register for VAT if their taxable turnover...

Starting a Business as a Sole Trader

Starting a business as a sole trader means lots of decisions to make and stuff to do. One of the first questions is whether to run the business as a sole trader to set up a partnership with others or whether to form a company How you operate your business determines...

Understanding Your UK Business Tax Obligations

UK business taxes impact every company, regardless of size or industry. Accordingly, understanding tax obligations helps businesses plan effectively. Additionally, knowing the different taxes applicable ensures compliance while avoiding penalties....

What You Need to Know about Tax Basics for Self Employed

Tax basics for self employed individuals are crucial for managing finances effectively. Unlike employees, we handle our own tax affairs, meaning we must register with the tax authorities, keep accurate records, and file tax returns on time....

You can’t pay your tax bill. What can you do?

What to do if you can’t pay your tax bill is a challenge many face, but there are solutions. Firstly, it’s important to stay calm and take action immediately. Ignoring the issue will only make matters worse. Additionally, remember that tax authorities...

Reverse Charging VAT in the UK

VAT reverse charging fundamentally shifts the responsibility of VAT accounting from the seller to the buyer. Unlike traditional VAT transactions where sellers collect and pay VAT to HMRC, the buyer handles the VAT declaration instead. Consequently, this mechanism...

Limited Company Taxes In The UK: Everything You Need To Know

Running a limited company in the UK can open up exciting opportunities. But it also comes with its fair share of responsibilities, particularly when it comes to taxes. For many business owners, the thought of dealing with tax obligations can feel overwhelming or even...

Explaining the Tax treatment for Sole Traders

Understanding the tax treatment for sole traders in the United Kingdom is crucial for managing your business finances effectively. Sole traders, unlike limited companies, operate without legal separation between personal and business finances. This...

Inheritance Tax: What It Is And How To Avoid Paying Too Much

.Inheritance tax is one of those things most of us would rather not think about, until we realise how much of an impact it can have on the wealth we’ve worked so hard to build. It’s a tax that can take a big chunk out of the money and assets you want to pass on. But...

How To Save Money For Taxes: Expert Tips For A Stress-Free Tax Season

For many business owners, taxes can feel like a never-ending puzzle, filled with confusing paperwork, complex regulations, and the fear of making a costly mistake. But don't worry, with the right tax strategies, you can easily handle this. In this blog (and video) you...

Benefits in Kind: Tax-Efficient Reward Strategies

Have you heard of benefits in kind? If you haven’t, then read on to find out how this particular strategy can increase your tax savings as a business owner. What are benefits in kind? Well, they are perks or advantages provided to employees (directors as well) in...

Tax Adjustments: Take Responsibility for Your Tax (Video)

Did you know that if you take responsibility for your tax, you have good chances of reducing your tax bills by making tax adjustments? This involves understanding and fulfilling your tax obligations. Understanding taxes in the UK In my video about the UK Tax System,...

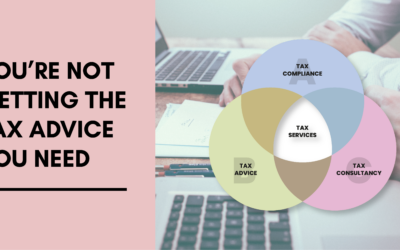

You’re not getting the tax advice you need

There’s an unspoken truth when it comes to tax advice: for business owners, there’s a complete lack of transparency from advisors over what tax advice actually is. This means as a business owner: …..you don’t know what to expect from your accountant …..you don’t...

Tax Effective Giving Benefits Everyone (Video)

Are you looking to make a difference while maximising your financial benefits? Tax effective giving is more than just a charitable act; it's a smart way to give back that can offer significant financial advantages. With tax effective giving, you can experience the joy...

Can’t Pay Taxes? Expert Tips on What to Do

The deadline for filing your taxes was 31st January 2023. And I’m sure you have filed them already. But now comes the time when you start worrying about having to pay the tax authorities what you owe. What if you can’t pay taxes right away? It’s not the best feeling...

Tax Obligations for CICs: A Brief Overview

Community Interest Companies (CICs) are a special type of company in the UK. They have a primary goal of benefiting the community or pursuing social objectives. Their involvement in the communities goes anywhere from arts engagement or enhancing technological literacy...

Tax responsibilities for Community Interest Companies

In today's podcast, we aim to explore and demystify the common misconceptions surrounding tax obligations for Community Interest Companies (CICs). As passionate advocates of business finance, we want to illuminate the intricate relationship between CICs...

VAT and Agent Relationships

In the dynamic realm of business, whether steering a private enterprise or a non-profit organization aspiring to make a social impact, one constant looms large – taxes. Amidst the myriad of taxes, VAT, or the rather awkwardly named Value Added Tax,...

2024 Tax Policy Changes for the Gig Economy

Are you part of the digital gig economy? Do you work on Upwork or Fiverr? Maybe you host on AirBnB. Major tax policy changes are underway in this segment. And I’m here to let you know exactly what so that you are prepared. Watch this video about the upcoming tax...