Dividends and the Director’s Loan Account are essential topics for any business owner who operates through a limited company. Firstly, dividends represent payments made to shareholders from a company’s post-tax profits. Unlike wages, dividends do not attract National Insurance contributions. Consequently, they are a tax-efficient way to reward shareholders. However, dividends can only be issued if the company has sufficient profits and positive reserves. Proper documentation, such as board meeting minutes and dividend vouchers, is a legal requirement.

Introducing the Director’s Loan Account (DLA)

A Director’s Loan Account (DLA) serves as a vital record within a company’s financial framework, meticulously documenting the intricate financial interplay between the company and its directors. Essentially, it functions as a ledger, meticulously tracking all financial transactions that transpire between these two entities. This encompasses a spectrum of activities, including instances where directors generously contribute their personal funds to bolster the company’s resources, or when they personally shoulder company expenses. In such scenarios, the DLA faithfully reflects these contributions as credits, acknowledging the director’s investment in the company’s well-being. Conversely, when directors withdraw funds from the company, receive reimbursements for company-related expenses, or draw a salary, these transactions are duly recorded as debits within the DLA, providing a transparent and accurate accounting of the director’s financial interactions with the company.

Link Between Dividends and DLA

The connection between dividends and the DLA is noteworthy. Whenever a DLA becomes overdrawn—i.e., the director owes money to the company—it may result in tax consequences. Accordingly, dividends are often used to clear these overdrawn balances, provided there are sufficient profits. Nonetheless, ensuring compliance with the Companies Act is vital to avoid penalties.

Key Considerations

Altogether, understanding these financial tools is vital for effective business management. Equally important is maintaining proper records and seeking professional advice. Notwithstanding the complexities, staying informed ensures you remain compliant while maximising benefits.

Final Thoughts

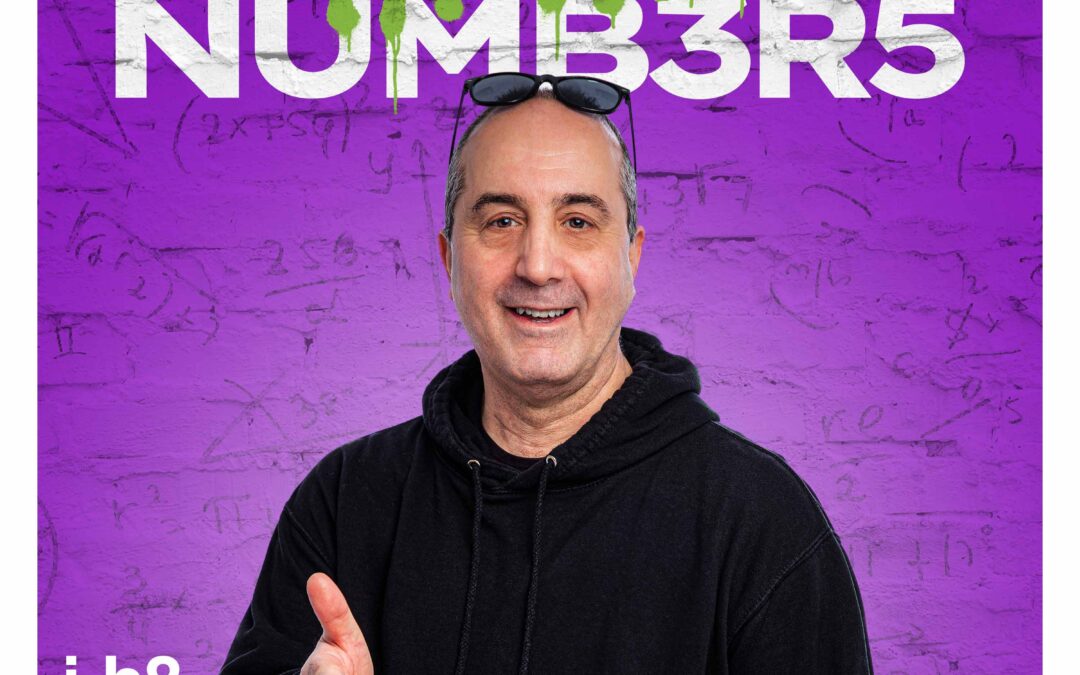

Lastly, dividends and the Director’s Loan Account are significant aspects of running a limited company. Therefore, staying aware of your legal and financial responsibilities is essential. For more insights and practical advice, listen to the I Hate Numbers podcast today and take charge of your business finances!