Above all, profit & your break-even point are so important to businesses that we’ve dedicated this blog and clip to this subject.

As a result you might be wondering why knowing about this is important.

Stay with me as we look at break-even. In short the bottom line is knowing your gives you better business insights and helps you make more profit in your business.

So let’s look at what this means. Your business breaks even when your sales covers all your costs, neither a profit nor a loss is made. However, you can look at break-even for your whole business, or for your individual products and services.

However that’s not all, break-even analysis can also show you how much profit or loss you can make at different sales levels. Therefore break-even is a powerful business management tool.

Before we show you how to look at this, there are a few good to know.

Costs: Two main categories, Fixed and Variable.

Fixed costs

Are time based, and unaffected by changes in how much we sell or make. They stay constant, and typical examples are:

• Wages and salaries

• Insurance

• Office rent

Variable costs

These costs fluctuate with changes in how much we sell or make

• Purchases: the amount fluctuates based on how much we produce and sell

• Sales commissions: the amount fluctuates based on how much we sell

However if you want to dig deeper, we’ve written some cool stuff on this in previous blogs, two spring to mind Cost Type and Understanding Costs.

Here’s how it works for business owners to connect to their break-even: –

i) Charts

ii) Numbers

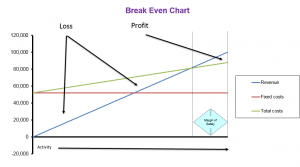

Break-even charts

Similarly a chart is a simple and visual way to show a bunch of numbers. For example a break-even chart is shown below with some made up numbers.

The following details are included in this chart:

• Vertical line shows the results in money terms

• Activity is typically what we produce and sell

• Fixed costs shown on the horizontal line,

• Total costs, fixed & variable costs. Starts from the fixed costs line

• Revenue (Sales). Starts from the point marked by 0. No sales, no money

• Break-even point is where the sales revenue and total costs lines cross

• Area of profit, known as the margin of safety, is to the right of break-even point

• The area of loss is to the left of break-even point.

Numbers

Therefore before we show you how to use numbers to connect to your break-even, the following are a a few good to know things.

Contribution

To clarify it’s the difference between selling price and variable costs, we can talk about in for each product, in total, or as percentage. I know that’s a lot to take in, but bear with me.

That is to say a good approximation, a rough and ready method is to use gross profit as contribution.

Let me tell you how this works with an example.

Example 1

Acme company has got together the following numbers for its business.

Fixed costs (FC) £12,000

Variable costs per unit £12

Selling price per item £20

Contribution per item £8 Contribution ratio = £8 ÷ £20 = 40%

Break-even point = FC/Contribution per Unit = £12,000 ÷ £8 = 1,500 units

Break-even point (£) = FC/Contribution per Unit × £20 = £30,000 before VAT

Break-even point (£) = FC/Contribution ratio = £12,000 ÷ 40% = £30,000 before VAT

Example 2

The simplified company has got together the following numbers for its business.

Fixed costs (FC) £6,000

Gross Profit % (GP%) £50%

Break-even point (£) = FC/GP% = £6,000 ÷ 50% = £12,000 before VAT

It all comes down to this. If you can connect to your break-even point, some of the things you can do include

• Figure out your initial sales targets

• Work out profit you make once you exceed break-even

• Use break-even as a yard stick to manage costs

• Focus on improving contribution and gross margins

• Scenario and business planning

• Help with going for growth

To sum up, give it a go, connect to your break-even and see what it means for your business.

We’d love to help

Contact us to see how we can help you with your business numbers .